What can the lender do? - Mortgage stress

If you are behind in repayments, there are steps that the lender needs to follow before they can exercise their rights to enforce the mortgage.

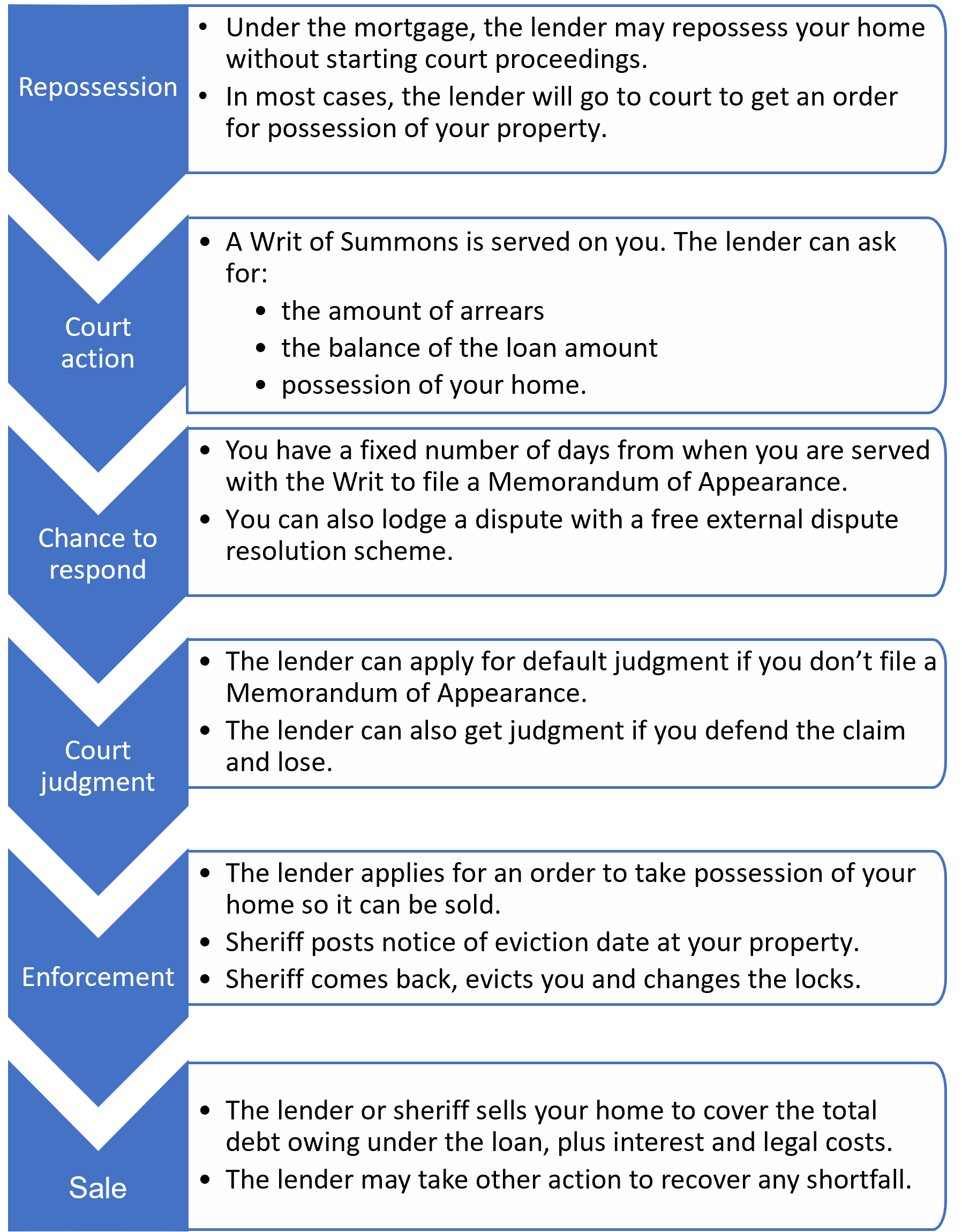

How can the lender enforce a mortgage?

How can the lender enforce a mortgage?

When you borrow money from a lender to buy a home the lender will take a mortgage over the house you are buying to secure the loan. The lender takes your home as security, so it can be taken from you and sold if you do not repay your home loan on time. This is called repossession.

The lender must have taken the steps above before it can repossess your home. The sooner you act, the more likely it is that you can negotiate a repayment arrangement that fits with your current circumstances.

Does the lender have to go to court to get possession of my home?

No, they do not have to go to court but they do so in almost every case.

One of the reasons they start court proceedings is to get a court order for the sheriff to evict you from the property so it can be sold. The picture below shows the process the lender can take to repossess and sell your home.

The most common exception when the lender doesn’t go to court is when the property is vacant or undeveloped land. If these situations apply to you your matter is urgent and you need to act as soon as you have received a Form 12 default notice.